san antonio property tax rate 2021

Its part of a 28 billion county budget set for approval on Tuesday Sept. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Thereafter interest will continue to be added at the rate of 1.

. The no-new-revenue tax rate would Impose the same amount of taxes as. 2021-2022 Debt Service Expenditures estimated 207897436. 2021 Official Tax Rates Exemptions Name Code Tax Rate 100.

212 of home value Yearly median tax in Bexar County The median property tax in Bexar County Texas is 2484. On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. This notice provides information about two tax rates used in adopting the current tax years tax rate.

Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value. Outstanding Unlimited Tax Debt. The tax rate varies from year to year depending on the countys needs.

Bexar County Texas Property Tax Go To Different County 248400 Avg. 2022-2023 Debt Service Expenditures budgeted. Pursuant with the Texas Property Tax Code.

Example - Penalty and interest will be added at a rate of 7 for February 2 per month for March through June and 3 for July. San Antonios fiscal 2021 tax rate of approximately 056 per 100 of TAV provides ample capacity below the statutory cap of 250. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. In fiscal year 2022 the MO tax rate will be 34677 cents per 100 taxable value. Thats nearly 13 lower than San Antonios total property.

Alternatively the city could exceed the revenue cap but doing so would trigger an. For example the tax on a property appraised at 10000 will be ten times greater than a. Jessica Phelps San Antonio Express-News After a contentious debate Bexar County.

You can pay your property tax online using any of the payment methods listed above.

Notice About 2021 Tax Rates Post City Of Grey Forest

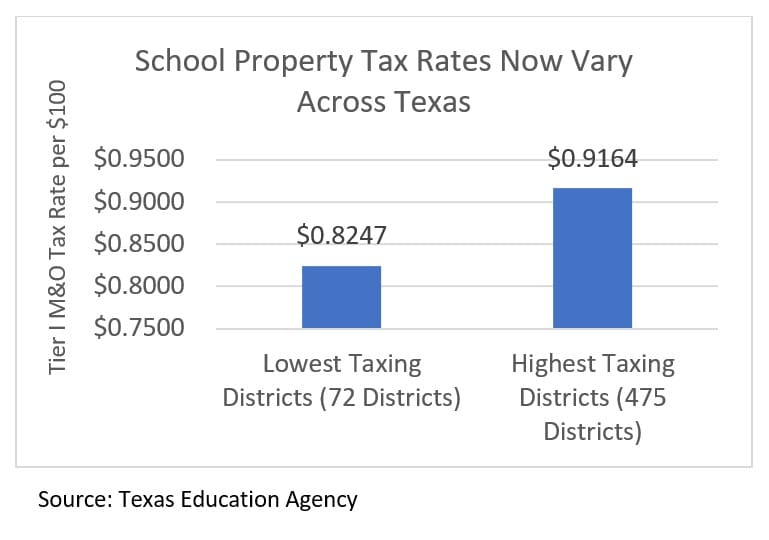

A New Division In School Finance Every Texan

Property Tax Loans Residential Commercial Lender Propel Tax

Property Tax Relief Coming To San Antonio Homeowners The City Of San Antonio Official City Website

Property Tax Calculator Estimator For Real Estate And Homes

What Are Commercial Property Tax Rates In Williamson And Hays County Texas

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Bexar County Approves 2 9 Billion Budget Maintains Current Property Tax Rate Ktsa

Budget Tax Notices Converse Tx Official Website

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Bexar County Tax Assessor Collector Albert Uresti Bexar County Tx Official Website

Most Texans Pay More In Taxes Than Californians Reform Austin

Bexar County Commissioners Approve Symbolic Property Tax Cut

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Tac School Finance The Elephant In The Property Tax Equation

/https://static.texastribune.org/media/files/23875c51ec04b56ad1cf1eb34e8fff96/Longview%20Housing%20File%20MC%20TT%2021.jpg)

Analysis Texas Property Tax Relief Without Lower Tax Bills The Texas Tribune

San Antonio Real Estate Market Stats Trends For 2022

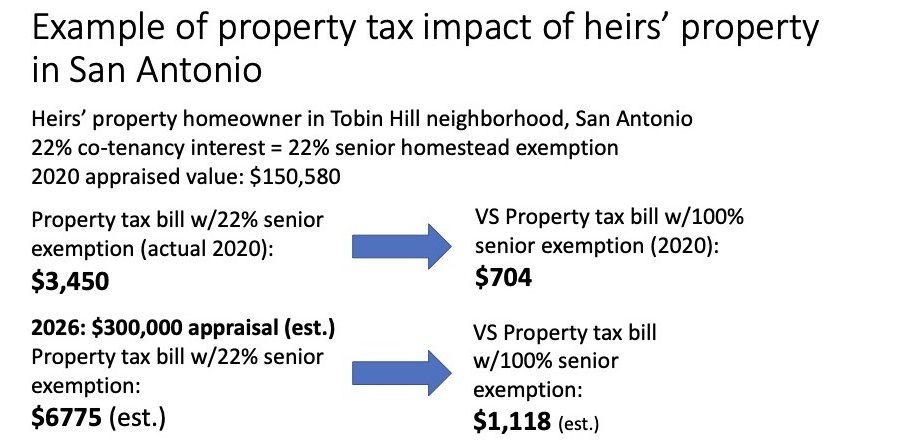

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

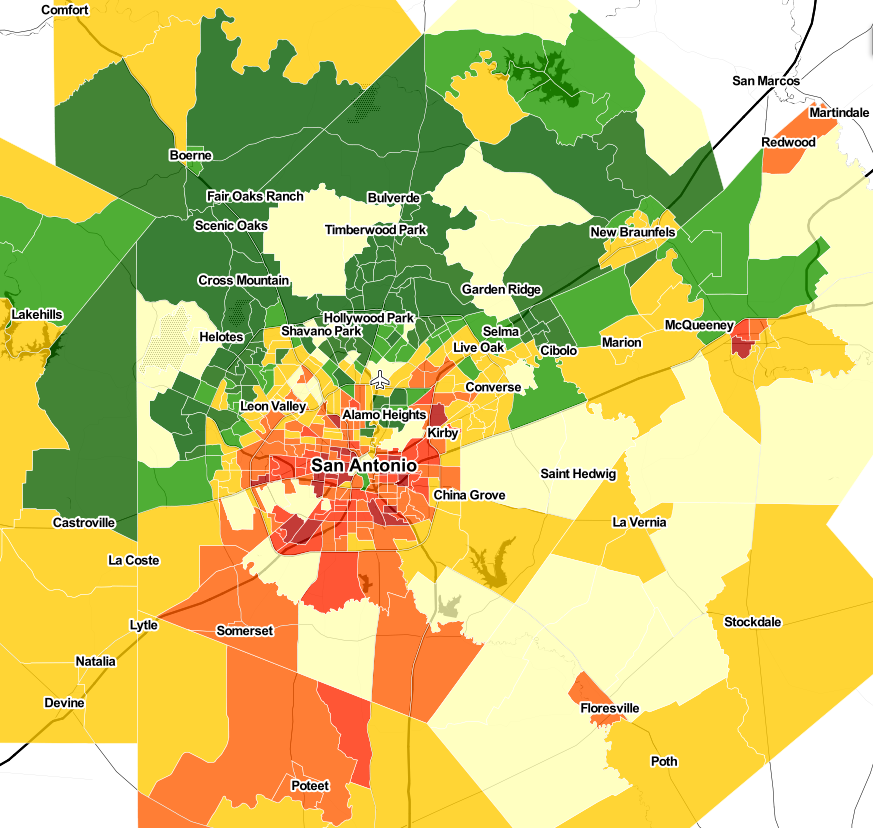

Taxprotestmap Property Tax Protests In Austin San Antonio And Houston